I published an eBook through

Amazon titled "Applying for Social Security Disability (SSD) Benefits or Supplemental Security Income (SSI)? 33 Commonly Asked Questions Answered."

A long title, but it leaves no doubt for the reader what the book is about.

If you have a

Kindle then you can get the book at

this link and in paperback through

Createspace.

About The Book:

Have you applied for or are considering applying

for either

Social Security Disability Benefits (SSD) or

Supplemental Security Income (SSI)? If so, then you likely have many questions that

need answering. This book provides very detailed answers to 33 commonly

asked questions related to the SSD and SSI processes by an experienced disability lawyer.

The following questions are answered in detail:

1. What Social Security Disability Benefits Are There?

2. What Is The Difference Between SSD And SSI?

3. What Is Social Security's Definition Of Disability?

4. What Is Substantial Gainful Activity?

5. What Is The Five Step Sequential Evaluation Process?

6. What Can A Social Security Attorney Do For Me?

7. What Is Sheltered Work?

8. How Far Back Can I Receive Back Payment?

9. What Does Date Last Insured Mean?

10. How Do I Find Out My Date Last Insured?

11. How Long Does It Take To Receive A Decision?

12. Are There Any Disabilities That Social Security Awards Benefits Faster To?

13. If I Don't Have Enough Work History Credits, Can I Still Get Benefits?

14. I Have A Private Long Term Disability Policy, Should I Also Apply for Social Security Disability?

15. How Important Are Medical Records When Applying For Social Security Disability?

16. What Is Reconsideration?

17. Do I Have To Pay Taxes On Social Security Disability Benefits?

18. I Was Recently Awarded SSD, When Do I Get Medicare?

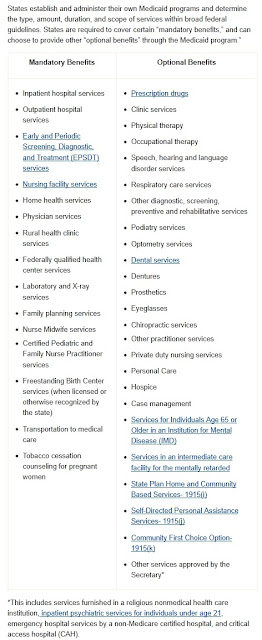

19. I Was Recently Awarded SSI, Do I Get Medicare or Medicaid?

20. How Long Are Doctors Or Hospitals Required To Keep My Medical Records?

21. Social Security Sent Me A Direct Express Card, What Is It?

22. What Is A Common Mistake Claimants Make That Is Easily Fixed?

23. Where Is My Local Social Security Office?

24. I Received Mail From Social Security, What Should I Do?

25. Can I Receive SSI If I Leave The United States?

26. I Worked On The Books, Why Does Social Security Say I Don't Have Enough Work History Credits?

27. My Doctor Is Not Willing To Cooperate With Social Security or My Lawyer, What Should I Do?

28. I'm A Veteran and Receiving Veterans' Benefits, Do I Also Get Medicare If I'm Disabled?

29. My Doctor Says I Am Disabled, Why Did Social Security Deny Me?

30. What Happens At The Social Security Disability Hearing?

31. If I Inherit Money Will That Affect My Social Security Disability Benefits?

32. Can I Apply For Both Early Retirement And Disability Benefits At The Same Time?

33. What Questions Does The Judge Ask At The Social Security Hearing?